403b Retirement Plan Calculation

Planning for retirement is an important part of any financial strategy, and a 403b retirement plan is a popular option for many nonprofit employees. In this blog, we'll discuss what a 403b retirement plan is, how it works, and how to calculate your contributions and earnings.

What is a 403b Retirement Plan?

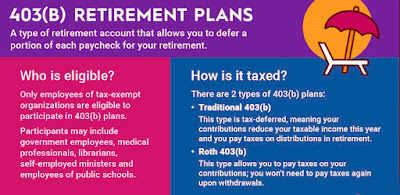

A 403b retirement plan is a tax-advantaged retirement savings plan for employees of nonprofit organizations, such as schools, hospitals, and charities. It's similar to a 401k plan, which is available to employees of for-profit companies. The main difference is that 403b plans are only available to nonprofit employees.

How Does a 403b Retirement Plan Work?

A 403b retirement plan works by allowing you to contribute a portion of your income to the plan, which is then invested in a variety of investment options, such as mutual funds or annuities. The contributions you make to your 403b plan are tax-deferred, meaning you don't pay taxes on the money you contribute until you withdraw it in retirement.

In addition to your own contributions, your employer may also make contributions to your 403b plan, either as a match to your contributions or as a discretionary contribution. These contributions are also tax-deferred.

How to Calculate Your 403b Contributions and Earnings

To calculate your 403b contributions and earnings, follow these steps:

1. Determine your contribution percentage: The first step is to determine how much you want to contribute to your 403b plan. The IRS allows you to contribute up to $19,500 in 2021, or $26,000 if you're over 50 years old.

2. Calculate your employer match: If your employer offers a match to your contributions, calculate how much they'll contribute based on their match percentage. For example, if your employer matches 50% of your contributions up to 6% of your salary, and your salary is $50,000, your employer will contribute $1,500 (50% of $3,000, which is 6% of your salary).

3. Determine your investment options: Choose how you want to invest your contributions, such as in mutual funds or annuities. Your investment options will affect your potential earnings.

4. Calculate your potential earnings: Your potential earnings depend on the investment options you choose and the performance of those investments. Use a 403b retirement calculator to estimate your potential earnings based on different investment scenarios.

Conclusion

A 403b retirement plan is a valuable tool for nonprofit employees to save for retirement. By contributing a portion of your income and taking advantage of your employer's contributions, you can build a strong retirement savings plan. Use a 403b retirement calculator to estimate your contributions and potential earnings based on different investment scenarios, and consult with a financial advisor to determine the best strategy for your specific needs.